Why Hire a Professional Advocate when Making a Building Insurance Claim?

Filing a building insurance claim after property damage can be a stressful and time-consuming process, especially when you're already dealing with the emotional and practical fallout of an unexpected event. Whether it's storm damage, a fire, or a flood, navigating the claim process without expert support can often lead to delays, confusion, or a lower settlement than you're entitled to.

This is where a professional advocate comes in. A building insurance claims advocate is a specialist who acts on behalf of the policyholder during the insurance claims process. While your insurer appoints an insurance adjuster to protect their interests, a claims advocate works solely for you, helping ensure your rights are upheld and your losses fully recognised.

In this article, we’ll explore what a claims advocate does, the key benefits of hiring one, and how Simon Levy can assist you with a successful building insurance claim.

What Is a Building Claims Advocate?

A building claims advocate is a professional who supports property owners through the insurance claims process following damage to a home or commercial premises. Their role includes interpreting your insurance policy, gathering evidence, assessing the damage, and negotiating with the insurer to ensure you receive the appropriate settlement.

Unlike an insurance adjuster, who represents the insurer and aims to manage their costs, an advocate works independently to protect your interests. They have in-depth knowledge of insurance terms, building regulations, and construction costs, and are often qualified property damage experts or work closely with surveyors, engineers, and restoration specialists.

Their goal is simple: to take the burden off your shoulders, expedite the claim process, and secure a fair outcome.

Why You Might Struggle Without One

While many insurance companies present themselves as helpful and straightforward, the reality of handling a building insurance claim can be far more complex. Policies are often filled with legal and technical jargon, making it difficult for property owners to understand exactly what their cover includes. This lack of clarity can lead to misinterpretations that may jeopardise the success of a property damage claim from the outset.

Another common challenge lies in the evidential requirements. Most insurers expect detailed proof of loss, including photographs, itemised damage reports, repair estimates, and supporting documentation that aligns with strict internal criteria. Without guidance, it’s easy to overlook key information or submit evidence in the wrong format, which can lead to unnecessary delays or even outright rejection.

On top of this, claimants are often expected to communicate directly with the insurer’s insurance adjuster, a professional whose role is to minimise the insurer’s financial liability. Even genuine, well-documented claims can be disputed or undervalued if the adjuster believes the damage is cosmetic, pre-existing, or not covered under the policy.

All of this comes at a time when the emotional and financial pressures of dealing with property damage are already high. This is why seeking property insurance advice from a professional advocate can make a significant difference.

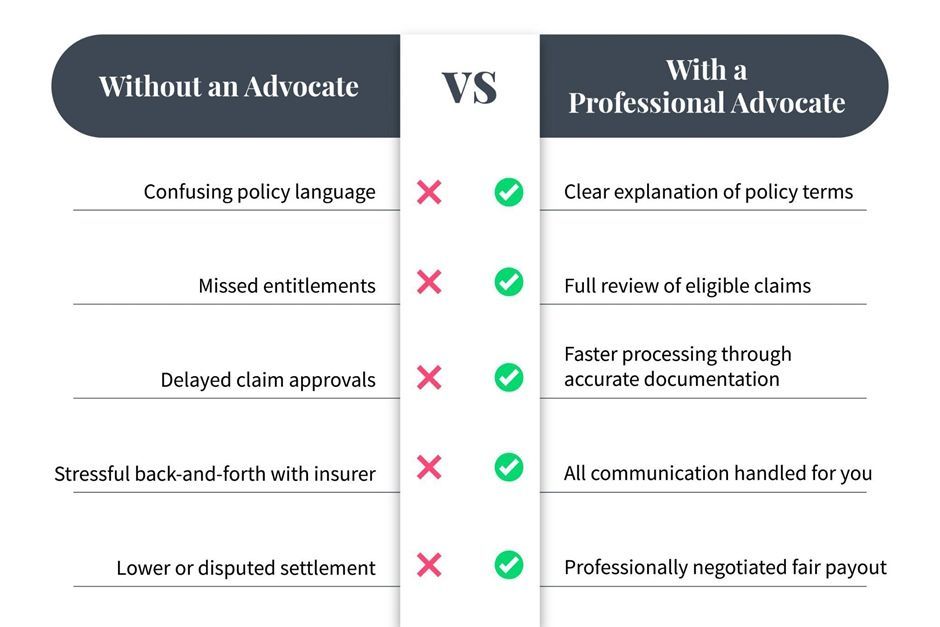

The Benefits of Hiring a Professional Advocate

Hiring a claims advocate means having knowledgeable property damage experts in your corner, someone who understands insurance, building structures, and the claims process inside and out. Here are the main ways they can help:

Policy and Jargon Expertise

One of the biggest hurdles in any property damage claim is understanding the fine print of your policy. A professional advocate can break down complex wording, identify what you’re entitled to claim for, and ensure nothing is overlooked. They’ll spot exclusions and limitations that could affect your payout, and help you avoid common mistakes that could lead to delays or denials.

Technical Knowledge of Property and Construction

Unlike general advisers, many claims advocates have a background in building surveying or work alongside qualified professionals. This means they can assess damage accurately, identify structural implications, and prepare detailed reports that insurers are more likely to accept. Whether it's understanding damp ingress, fire-damaged joists, or subsidence, they speak the language of both insurers and builders.

Skilled Negotiation with Insurance Adjusters

Insurance adjusters are trained to scrutinise property damage claims and control costs. A professional advocate knows how to present your case, challenge unfair assessments, and support every aspect of the claim with evidence and industry knowledge. Their negotiation skills can make the difference between a partial settlement and a comprehensive one.

Faster, Smoother Claims Process

Because advocates know the process inside out, they can help avoid delays. They’ll ensure all documents are correctly completed, deadlines are met, and nothing is left out. This proactive approach often leads to quicker claim resolutions and less back-and-forth with insurers.

Reduced Stress and Greater Confidence

Dealing with insurance can feel like a second full-time job, and when it’s your home or business on the line, the stakes are high. With a professional handling your building insurance claim, you can focus on recovery, knowing the process is in capable hands.

How Simon Levy Associates Can Help With Your Building Insurance Claim

At Simon Levy Associates, we understand how difficult it can be to manage a building insurance claim, particularly when faced with disputes, poor communication from insurers, or undervalued settlements. That’s why we offer a hands-on service designed to support homeowners and businesses through the entire insurance claim process.

Our team of property damage experts has extensive experience working on property damage claims involving fire, flooding, storm impact, and structural issues. We don’t just offer property insurance advice, we actively manage your claim from start to finish, liaising with your insurer and making sure your losses are properly assessed and compensated.

With Simon Levy, you’re not just hiring a service, you’re gaining a partner who understands the technical, legal, and emotional aspects of property damage claims. If you’re dealing with property damage and want expert support in making a building insurance claim, don’t go it alone. Contact us today to arrange a consultation or learn more about how we can help.